Overview

Opportunity Zones

A new program to connect private investment to low-income communities nationwide

Overview

The Opportunity Zones program was established by Congress in the Tax Cut and Jobs Act as an innovative approach to spurring long-term private sector investments in low-income urban and rural communities nationwide. The program is based on the bipartisan Investing in Opportunity Act.

The program establishes a mechanism that enables investors with capital gains tax liabilities across the country to receive favorable tax treatment for investing in Opportunity Funds that are certified by the U.S. Treasury Department. The Opportunity Funds use the capital invested to make equity investments in businesses and real estate in Opportunity Zones designated by each state.

Program Need

- More than half of America’s most economically distressed communities contained both fewer jobs and businesses in 2015 than they did in 2000.

- New business formation is near a record low. The average distressed community saw a 6% decline in local businesses during the prime years of the national economic recovery.

- The U.S. economy is increasingly dependent on a handful of places for growth. Five metro areas produced as many new businesses as the rest of the country combined from 2010 – 2014. Now is the time to diversify.

Investor Incentives

U. S. investors currently hold $2.3 trillion in unrealized capital gains, representing a significant untapped resource for economic development. Opportunity Funds will allow these investors throughout the country to deploy their resources as Opportunity Zone investments.

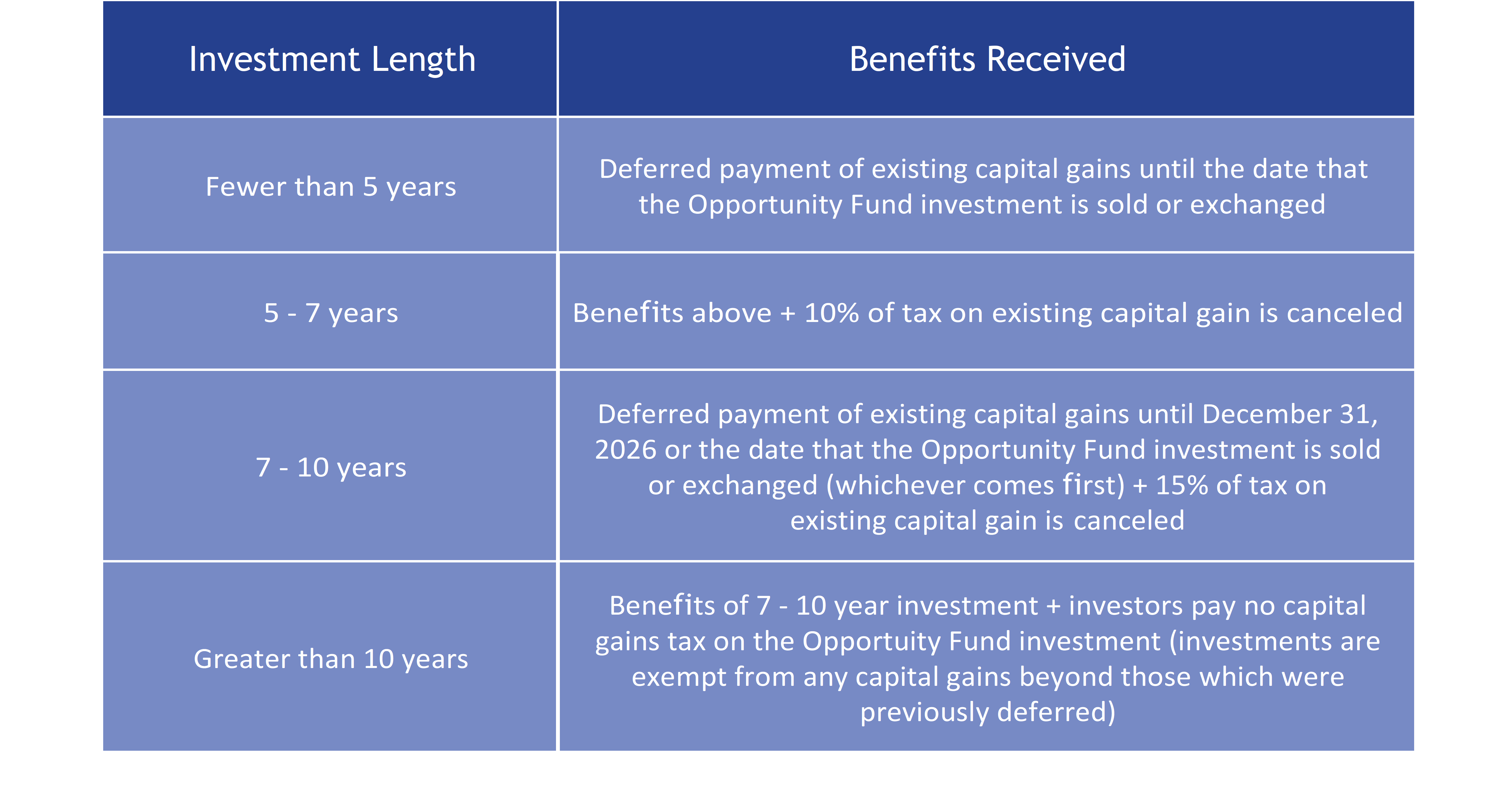

The Opportunity Zone program is designed to incentivize long term investments:

Investment Example

Investment Example

In 2018, an individual investor sells 1,000 shares of Amazon stock that they purchased in 2013 for $250,000. The sale at $1,250 per share results in a $1 million capital gain. Instead of paying the $238,000 in federal capital gains tax on this sale, the investor rolls their $1 million gain into a Qualified Opportunity Fund that invests the capital in newly issued preferred stock shares of various operating businesses located in Opportunity Zones with a plan to liquidate the fund in 2028. The assumed value of this investment in 2028 is $2 million. The benefits received by this investor include:

• Investing $1 million instead of the $762,000 that would be remaining if the capital was not re-invested into an Opportunity Fund.

• Paying $202,300 in taxes in 2026 instead of paying $238,000 in 2018.

• Owing no additional tax on the $1 million in capital gains on the Opportunity Fund investment realized in 2028.